We help businesses succeed in a dynamic economy by enabling sustainable and resilient supply chains.

The fast-moving, interconnected world we enjoy today is powered by effective supply chains. We work with some of the world’s most recognised companies to help them to deliver goods that make everyday lives better.

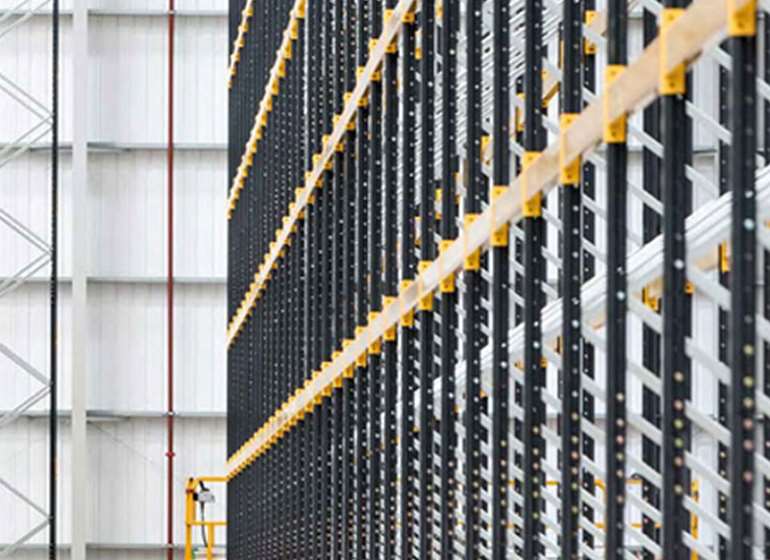

By investing in logistics hubs and warehouse space – supported by the latest technologies – we enable our customers to achieve economies of scale, create great places to work, and be socially and environmentally responsible businesses. In providing these companies with the space to succeed, we can generate investment returns for investors in our publicly listed funds – Tritax Big Box REIT plc and Tritax EuroBox plc – and private market products.

Our aim is to create long-term value for our investors, our customers – and the communities in which they are based.

About us